32+ 5 mortgage how much can i borrow

Ad Looking For A Mortgage. Grow Your Business Now.

Are You Having An Openhouse Get A High Quality Flyer Customized To Your Property With A Rate Table Prepare Mortgage Loans Mortgage Marketing Mortgage Savings

Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act.

. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75. Now say the mortgage rate is 4 and you want to take out a mortgage loan with a term period.

Think carefully before securing other debts against your home. Get Started Now With Rocket Mortgage. Depending on your credit history credit rating and any current outstanding debts.

Use our mortgage borrowing calculator and discover how much money you could borrow so that you can own your own home. Ad Short or Long Term. Get Started Now With Rocket Mortgage.

If you want a more accurate quote use our affordability calculator. This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow from a mortgage lender. Find out how much you could borrow.

Compare Mortgage Options Get Quotes. But this will vary depending on the lender and the type of mortgage. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

For this reason our calculator uses your. 9000000 and 15000000. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

You can borrow a minimum of 5 and a maximum of 20 of the propertys full price. Its A Match Made In Heaven. The MIP displayed are based upon FHA guidelines.

Get a Commercial Real Estate Loan From The Top 7 Lenders. These are your monthly income usually salary and your. The calculator is free and easy to use simply enter a few key.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. The first step in buying a house is determining your budget.

How much can I borrow. Compare Mortgage Options Get Quotes. Use our mortgage calculator to see how much you may be able to borrow with a NatWest mortgage our mortgage rates and what.

Were Americas 1 Online Lender. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Were Americas 1 Online Lender.

Its A Match Made In Heaven. FHA requires a 35 down payment as well as an upfront and monthly mortgage insurance in many cases. Based on your current income details you will be able to borrow between.

Typically you can borrow up to 45 times your income for a mortgage. Mortgages are secured on your home. Other loan programs are.

Let your total annual housing expenses and other monthly debts be 500 and 200 respectively. Ad Looking For A Mortgage. Saving a bigger deposit.

There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. You could lose your home if you do not keep up payments on your mortgage. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today.

For instance some deals offer 55. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. Arizona Mortgage Banker License 0911088.

Ad Work with One of Our Specialists to Save You More Money Today. This mortgage calculator will show how much you can afford. Fill in the entry fields and click on the View Report button to see a.

Choose The CRE Mortgage that Fits Your Business Needs.

Personal Loan Contract Template Awesome 40 Free Loan Agreement Templates Word Pdf Template Lab Contract Template Business Rules Personal Loans

Lending Money Contract Template Free Luxury Cash Loan Agreement Sample Borrow Money Contract Form Contract Template Agreement Contract

Wondering If You Should Buy A Home Today Experts Say Home Prices Will Continue To Appreciate In The Comin In 2022 Mortgage Loan Originator House Prices Home Ownership

What Is Loan Refinance What Are The Benefits Of Refinancing Refinance Loans Refinance Mortgage Loan

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Pin On Finance Infographics

Loan Constant Tables Double Entry Bookkeeping Mortgage Loans Loan Mortgage Calculator

Prospect Home Loans

Quicken Loans Mortgage Review 2020 Smartasset Com Quicken Loans Mortgage Mortgage Loans

Va Loan Pre Approval Process Va Loan Mortgage Loans Mortgage Loan Calculator

What Credit Score Is Needed To Buy A House Credit Score Credit Score Chart Credit Score Repair

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2018 Fha V Fha Loans Conventional Loan Mortgage Loans

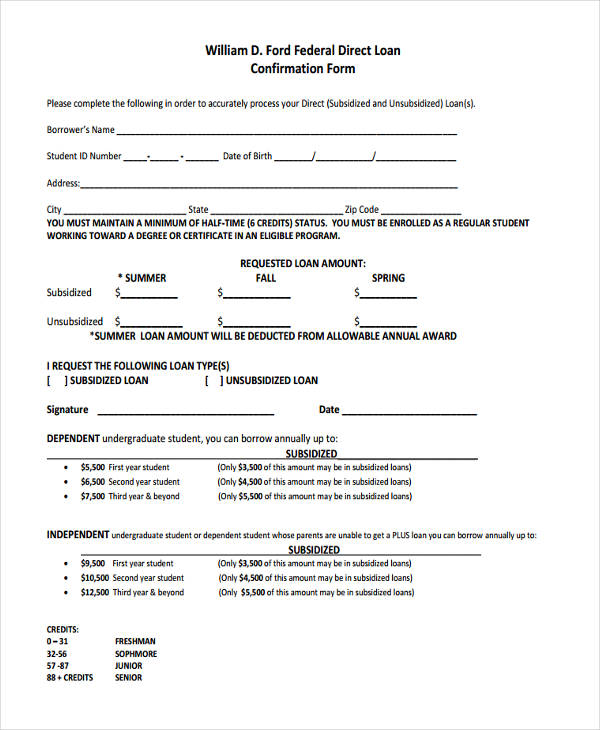

Free 8 Loan Confirmation Forms In Pdf

Bailey S Tips Come See Us At Bailey S Furniture The Home Of The No Credit Check Finance Also 6 Months Layaway Real Estate Tips Home Buying The Borrowers

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person